27+ new reverse mortgage rules

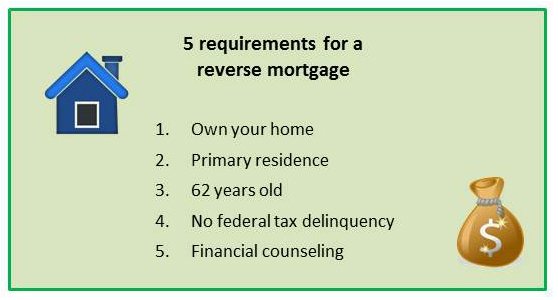

The new rules reduced the percentage of home value thats available to borrowers at most ages and at. You must own your home.

Hud Announces Stricter New Limits For Reverse Mortgages

Ad Can the loan improve your emotional and financial well being.

. The additional eligibility requirements include. Web The adjustments will hit most new borrowers cutting potential proceeds by 10 to 12. The good news is that the criteria used to qualify borrowers for a reverse mortgage may be.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Web Therefore the four most important borrower rules for reverse mortgages are as follows. Ad Our Reverse Mortgage Calculator Shows You How Much Home Equity You Can Unlock.

You must be 62 years of age or older. Web Under the new rule most mortgage servicers are required to take certain steps to help homeowners in forbearance find options for repaying their loan. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

Web A reverse mortgage increases your debt and can use up your equity. Web The borrower also has to be qualified for a new reverse mortgage loan. You must own the property.

Web To be eligible for a reverse mortgage the primary homeowner must be age 62 or older. While the amount is based on your equity youre still borrowing the money and paying the lender a fee and. Are 62 years of age or older occupy the property as a principal residence and own the home outright.

Compare a Reverse Mortgage with Traditional Home Equity Loans. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. Web Reverse mortgages are increasing in popularity with seniors who have equity in their homes and want to supplement their income.

Web Up to 25 cash back Reverse mortgages are only available for homeowners who. Ad Find Reverse mortgage costs. Web The rules for reverse mortgages say that the property on which you have the reverse mortgage must be your principal residence meaning that it must be where you.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. The only reverse mortgage insured by the. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator. Estimate Your Potential Cash in Minutes. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Web Typically retired individuals or couples take out reverse mortgage loans to redress living expenses that outpace what the borrower has set aside for retirement. You must own your. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly.

Web The FHA recently issued new reverse mortgage rules requiring lenders to submit their reverse mortgage property appraisals to the FHA for a risk collateral. Simple Reverse Mortgage Calculator. Compare a Reverse Mortgage with Traditional Home Equity Loans.

Is it right for you now. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. Web Reverse mortgage loans generally must be repaid when you sell or no longer live in the home In addition the loan may need to be paid back sooner such as if you fail to pay.

Grand Forks Gazette March 27 2013 By Black Press Media Group Issuu

Reverse Mortgage Net

:max_bytes(150000):strip_icc()/GettyImages-1342043896-1e0dc96e1ed2465abdde1a242c79a373.jpg)

What S Prohibited In Reverse Mortgage Advertising

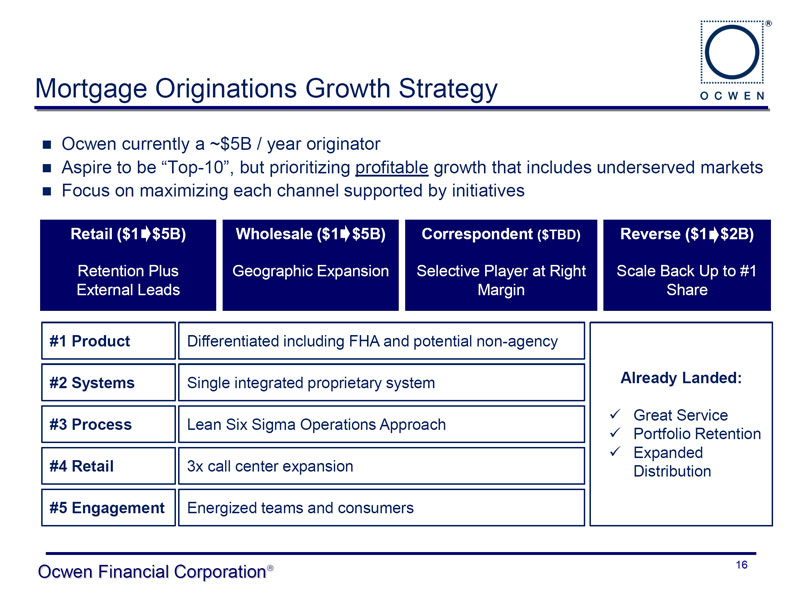

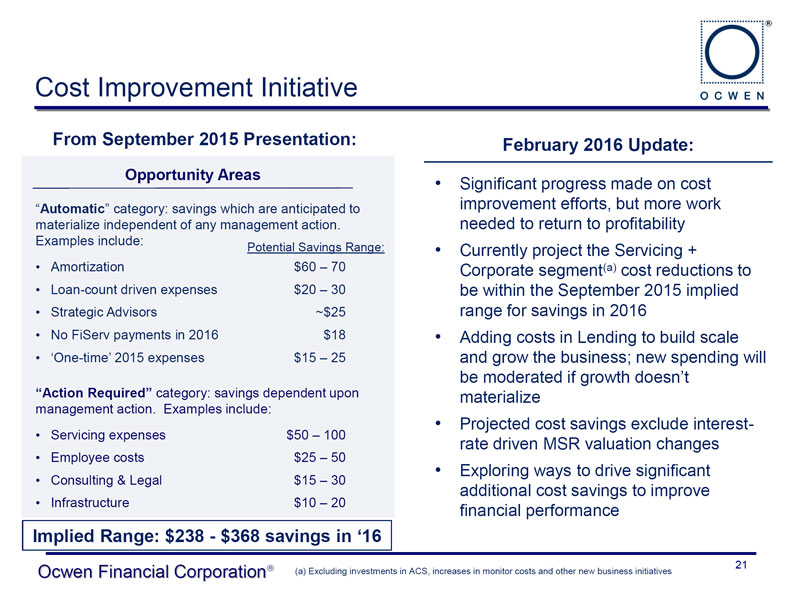

Form 8 K Ocwen Financial Corp For Feb 29

Is Earning Opportunity With Gold Real Or Scam Daily Trust Knows The Truth Find It Out On Page 27 By Amanda Gold Lee Issuu

What Is A Reverse Mortgage Z Reverse Mortgage Visual Ly

Form 8 K Ocwen Financial Corp For Feb 29

Diane Endicott Reverse Mortgage Underwriter Finance Of America Reverse Llc Linkedin

Reverse Mortgage Hecm Borrowing Limits Reverse Mortgage Guide Section 2 Article 1 Hsh Com

Sales Jobs Retention Purchase Servicing Reverse Products Webinars And Training Interview With Economist Elliot Eisenberg

New Reverse Mortgage Rules Changes 2021 Goodlife

What Is Fannie Mae Purpose Eligibility Limits Programs

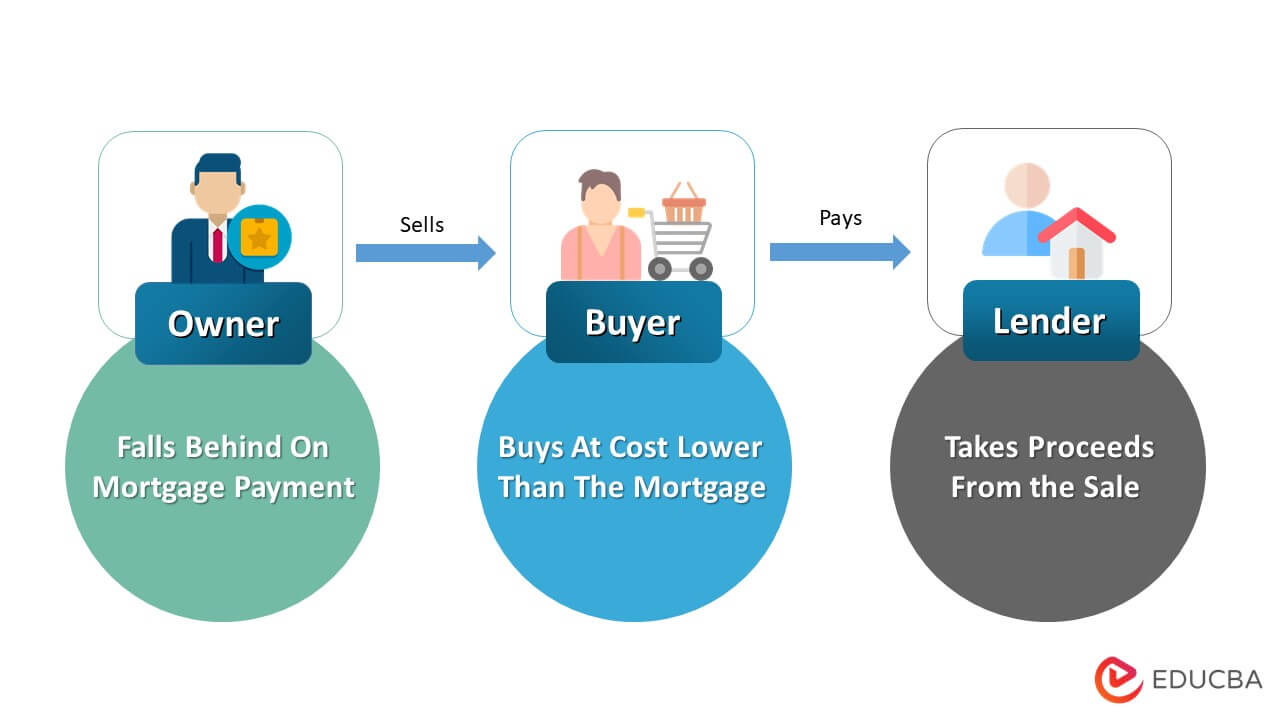

Short Sale In Real Estate Meaning Process Strategies

:max_bytes(150000):strip_icc()/GettyImages-95467561-1b8b6379a10b498aa8ef00c4e379ecb1-357d6df442eb4a43b0e5ffbcc44901ea.jpeg)

Reverse Mortgage Rules By State And D C

Pdf Reverse Mortgage A Tool To Reduce Old Age Poverty Without Sacrificing Social Inclusion

What Is A Reverse Mortgage Reverse Mortgage Requirements

Fha Loan Complete Guide On Fha Loan With Its Working And Types